Joining the Million Dollar Club/Challenge and So Can You

Today, we are going to talk about networth and how we are joining the Million Dollar Club/Challenge which is a club/challenge that can be joined by anyone who wants to be a millionaire, or who’s already a millionaire and wants to continue progressing.

A millionaire is someone who has a networth of at least one million. Investopedia defines networth as “The amount by which assets exceed liabilities. Net worth is a concept applicable to individuals as a key measure of how much an entity is worth. A consistent increase in net worth indicates good financial health”.

In summary, to calculate your networth, you add all your assets and deduct all your liabilities. It’s a good way to track how you are progressing and how close you are to being financially independent.

The good thing about tracking your networth, is that you get to see where you are doing great and where you need to improve. In our case, we started tracking our networth in December last year, and we will continue tracking/updating it at least once year.

A lot of personal finance bloggers, including ourselves, publicly disclose/track our networth in order to motivate ourselves and our readers. The tracker can be found here: Rockstar Finance Networth tracker.

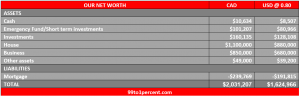

Our networth

Below, are the details of our networth. We are showing the amounts in both Canadian dollars and US dollars for our American and international readers and for also tracking purposes with the Rockstar Finance Networth tracker.

Assets

$100K Emergency Fund/Short term investments

As you can see we have a lot in emergency fund/short term investments. We are paranoid about going back to being broke so we keep a healthy emergency fund. In one of our previous post, we talked about how we spend only 15% of our income.

Therefore, that $100K emergency fund can last us more than 2-3 years should both of us stop working.

Note that a lot of it is in short term investments, and not just sitting around in a savings account collecting $0 interests, or laying under the mattress collecting dust 😊.

House

We live in HCOL (High Cost Of Living) area and we have had real estate agents knock on our door offering $1.3M+ but we are staying put and raising Baby99to1percent and any future babies here. Once they are out of the house, we might then downsize and cash in.

And we are valuing the house at only $1.1M, instead of the $1.3M+ we have been offered since the government is introducing a lot of new rules trying to cool down the real estate market.

But at the same time, they are limiting the number of detached houses to be built, thus we think our detached house will continue to increase in value year after year.

We bought the house for $560K 5 years ago, added $40,000 in upgrades for a total of $600K. We took a 30 year mortgage and since we were about to get married, and dealing with wedding expenses, we took the risk and put down only 5% instead of the recommended 20% (I know, shame on us 😊).

It turned out not to be a bad idea actually, because if we had waited a year or 2 to come up with the 20%, we would have been priced out since in our neighborhood, houses have been increasing about $100K+/year.

The consulting business

We are conservatively valuing the business at $850K, because we won’t really know how much it’s worth until we sell it if ever. We have had offers, but we are not entertaining anything below a certain amount.

The business is in a very nice, small but potentially lucrative niche. We just found an even easier way to recruit clients, and now we have to figure out an easier way to recruit the specialized, talented employees that we need in order to service the clients.

We feel that if we stick with it, it has the potential to make us millions a year and it might be our ticket from the 1% to the 0.01%. This blog is about progress, prosperity and financial independence after all.

Other assets

Other assets include 2 cars and an engagement ring. Mr99to1percent bought the ring online at a discount for $20,000. When we had to appraise it for insurance purposes, it was appraised at $30,000 and last year, when we wanted to switch to a cheaper insurance, we were required to have it re-appraised, and we were surprised to see that it had increased in value to $35,000.

The 2 cars that we own are my 13-year-old sedan and Mr99to1percent’s 11-year-old SUV. We don’t have any car loans, and we drive our cars until they completely fall apart.

Liabilities

Our Mortgage

Our mortgage is our only debt and we have a vision (Vision 2020) of paying it off in 2020 at 39 years old. We are trying to pay off $80K-$100K/year and that will allow us to meet our vision (see details here). With a new baby, it’s been challenging but we are determined to pay it off by 2020.

Other liabilities

We don’t have any other liabilities. We pay off our credit cards each month. I can’t remember the last time I paid interest. I always say that instead of giving the money to the bankers, give it to charity instead.

How did we do it?

- We paid off student loans before graduating. In this blog post, we detailed how we moved from broke with a negative net worth (student loans, car loans, ) to finding good jobs, and paying off student loans before graduating.

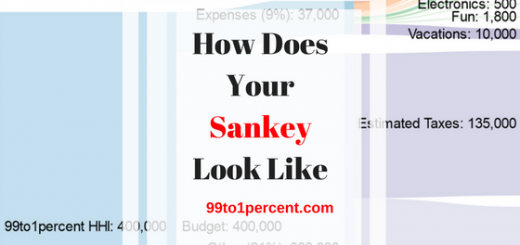

- We increased our income from $0 to $160K to $400K+. And we plan to continue doubling it every 5 years. Join our challenge here.

- We bought our dream (to us) house as soon as we could. If we had waited we could not have done it. We might downsize and cash in once the kiddos are grown and out.

- We are paying off the mortgage faster which will save us $500K in interests and give us the freedom to become more aggressive and increase our income.

- We only spend 15% of our income. We only spend about 15% of our income.

- We read personal finance / career books. Check out our recommended personal finance/career books.

Joining the Million Dollar Club/Challenge

Like I previously mentioned, the good thing about tracking your networth, is that you get to see where you are doing great and where you need to improve. For example, even though our networth seems high on paper, in reality, it’s not enough for us to be financially independent as most of it is tied to the house equity and the business.

Like I previously mentioned, the good thing about tracking your networth, is that you get to see where you are doing great and where you need to improve. For example, even though our networth seems high on paper, in reality, it’s not enough for us to be financially independent as most of it is tied to the house equity and the business.

Yes, we can decide to sell and cash in, but what if we decide not to cash in and to give those 2 assets to our kid(s)? After all, it’s all about leaving a legacy. Just because we had to suffer and fend for ourselves, put ourselves through school, incurred student loans, worked 2-3 jobs at the same time, lived in not so safe neighborhoods, barely had food to eat, hustled and saved like maniacs to be able to buy our first home and start our first business; doesn’t mean that we should let our kid(s) also suffer and fend for themselves.

That’s why our goal for the next 9-10 years, is to double our networth to $4M. At that point, we will consider ourselves fully financially independent and will be able FIRE (Financially Independent, Retire Early) if we choose to do so. Wouldn’t be sweet to FIRE at 45 years old?

The $4M would not only allow us to FIRE comfortably, but to also pay for our kids’ education, help them become homeowners themselves in this crazy expensive real estate market, and hand over the business to them if they want it.

The $4M would also facilitate our lifelong dream of setting up school(s) for kids, especially underprivileged kids. We tried to start the project this past spring, but we realized how expensive and time consuming it was, especially dealing with government bylaws and bureaucracies.

We ended up wasting thousands of dollars for nothing, and thus, the project has been suspended until we FIRE and have enough money and time to manage the project.

Therefore, we have decided to join J.Money’s Million Dollar Club/Challenge in order to stay focused and motivated. Note that the club can be joined by anyone who wants to be a millionaire, or who’s already a millionaire and wants to continue progressing.

Our Pledge

In order to achieve the $4M networth in 9-10 years, we pledge to:

- Continue living below our means, ideally between 15%-20% of our income

- Pay off the mortgage by 2020

- Find ways to continue to double our income every 5 years. Join our challenge here.

- Grow our consulting business every year, by adding clients and employees every year.

- Continue having/creating multiple streams of revenues.

- Double our networth to $4M by the time we are 45 years old.

Can we reach that $4M networth by 45 years old? We think so. We are only in our mid 30’s, and just starting out. Watch this space 😊.

What about you guys? When do you plan to become financially independent? What do you think about the Million Dollar Club/Challenge? Will you join? Or have you already joined? If so let us know where you are with your target.

Thanks for reading. Please feel free to comment, share and subscribe! We love ya and wanna get to know ya!

Do you want an easier way to manage/track your finances/investments? The Personal Capital app can help. Do you want to start blogging? Bluehost can get you started. Make sure to also check out other resources that we recommend such as books that have helped us get where we are.

Do you want to learn more about us? If so, you can also read these posts

- About us

- How We Increased Our Annual Income From $0 to $160K to $400K+

- How we live on 15% of our income

- Joining the Million Dollar Club/Challenge and So Can You

- How To Pay Off A Mortgage In 5 Years

- Our Biggest Money Fight and 9 Lessons Learned

- Our 6 Financial Mistakes and 15 Lessons Learned

- How I Paid Off My $40,000 Student Loans Before Graduating

- The resumes that bring in $400,000+/year (Samples Provided)

You may also like...

17 responses

-

[…] Track your net worth. You can’t improve what you can’t measure. We track ours on an annual basis. […]

-

[…] Joining the Million Dollar Club/Challenge and So Can You […]

-

[…] Joining the Million Dollar Club/Challenge and So Can You […]

-

[…] 99to1percent’s $4 million pledge! […]

-

[…] 99to1percent’s $4 million pledge! […]

Welcome to the club 🙂

Thanks J, very well appreciated.

Yes, you can do it. If you did $2m in the past 10 years, you can do another $2m in the next 10 years. Maybe even more?

Hi Jennifer,

I agree. They say the first million is the hardest…

But yet again some people also say the first billion is the hardest 😀

With your multiple income streams and frugal living, I fully expect that you will achieve your $4M in net worth goal. But, because of your ambition and financial sophistication, it surprises me that you would choose to leave so much of your capital tied up in your home. If you were to free hundreds of thousands of dollars now with a refinance and use that money to invest in rental property, you could increase your cash flow now, enjoy the unparalleled tax benefits, and build that passive income that you are looking for in your early retirement.

Hi Kat,

I wish we could do that but where we live has become crazy expensive. Adding another 1.3-1.5 million dollar mortgage plus the hustle of renting is not worth it to us. But should this overpriced market crash (even though we don’t wish for that as it would negatively affect a lot of people) we will make sure to to scoop up a few more properties: Buy low, sell high strategy.

You definitely can make it to 4M. You have a lot of time and resources. I am 45 this year and trying to do the opposite. Make a little less and enjoy life!

That’s great. Hoping to do the same when we reach 45 🙂

Agree with Kat, not sure why you’d lock so much capital in a house. I understand your comment on the market where you live but there are other investing vehicles you could take advantage of to maximize cash flow (e.g out state REI). You could also invest in your business to grow it further. Anyways welcome to the club and keep things going!

Just trying to do a little bit of both (investing and getting rid of debt) to make sure we hopefully come out of the next recession unscathed.

Plus the affordable out of state RE is still way higher than the national average and it’s a 7 hour drive from here, and we are not ready for that…Maybe once we FIRE and have a lot of free time?

As for the business, we invest what’s necessary, we wouldn’t want to overdo it bcz we could easily find ourselves heavily indebted or bankrupt.

I’m in the same boat as you, but a couple years higher.

We are sitting at about $2.2 million CDN net worth at the moment and the goal is to be at $4 – $5 million within five and $6.75 within eight years.

We’ve a lot invested in real estate: single family home being built, rental apartment and rental townhouse being built.

Our goal will be adding one to two rental properties per year and saving 40% to 50% of our salaries.

Are you in Vancouver or Toronto? Given your comments on cooking down the market, I’d guess Vancouver and given my real estate holdings, you could guess why that would worry me!