How To Pay Off A Mortgage In 5 Years

Hello readers,

Today, we are going to talk about how to pay off a mortgage in 5 YEARS drawing on our own experience. As part of the plan to achieve financial independence, we have what we have dubbed Vision2020: To pay off our $550,000 mortgage in 5 years by 2020 at the age of 39 years old.

We understand that not everyone can pay off their mortgage in 5 years, however these tips are relevant whether you want to pay off your mortgage in 5, 8, 10, or 15 years. We want to challenge our readers to find a way to pay off their mortgage within 15 years max, ideally 5-10 years.

The amount of interest you will save will be huge, and you will come closer to achieving financial independence, and allow yourself more freedom to take risks. I will expand on the benefits a little bit further below.

If you think, you won’t be able to pay off your mortgage within 15 years, consider other options such as:

- Buy a smaller house

- Buy in a different location/suburb

- Continue renting

- Find ways to increase your income

Our initial plan was to pay it off in Dec 2019. But with a newborn (kids are expensive!), our new plan B is to pay it off in September 2020 at 39 years old.

How it all started

One month before getting married, on a Saturday morning, I saw an email notification about a new listing, and I thought it was a nice house but a little too expensive for us, and in a suburb we had never been.

After I nagged begged my husband to come with me to check it out just for fun, he reluctantly came with me. Well, he fell in love with the suburb and the house and he wanted to buy it right away (Ha! Story of my life 😊)

I also fell in love with the suburb and the house, however, I still thought it was too expensive and also wanted to check out other houses in that same suburb. That weekend and Monday after work, we checked out as many listings as we could, and narrowed it down to 3 favorites.

Monday night, we spent the whole night debating on which house to pick. We finally agreed on one house, that was a little bit newer, a little bit less expensive and with potential for customizing it for ourselves.

And on Tuesday around midnight, we were sitting down with our realtor, the sellers and their realtor, negotiating the sale price and conditions. We finally signed the deal around 1am. It was a 2300sq, 4 bedroom, for $557,000.

We took a 30 year mortgage and since we were about to get married, and dealing with wedding expenses, we were able to put down only 5% instead of the recommended 20% (I know, shame on us 😊).

It turned out not to be a bad idea actually, because if we had waited a year or 2 to come up with the 20%, we would have been priced out. In our neighborhood, houses have been increasing about $100K/year.

But because we did not put at least 20% down, we were charged an insurance premium of $15.6K plus 8% PST, so all and all, our mortgage ended up being $544,759.90.

Where does your money go?

Well from mid 2012 to mid 2015, we only paid the required minimum payment. We did not bother paying any extra. In all fairness, we had a lot going on, we did $40,000 in upgrades and we also did some international traveling.

But in 2015, after I showed hubby how most of our payments go to interests and very little goes to principal, he agreed with me that we should sacrifice some of the luxuries and try to pay off our mortgage a little bit faster within the next 5 years no later than 2020.

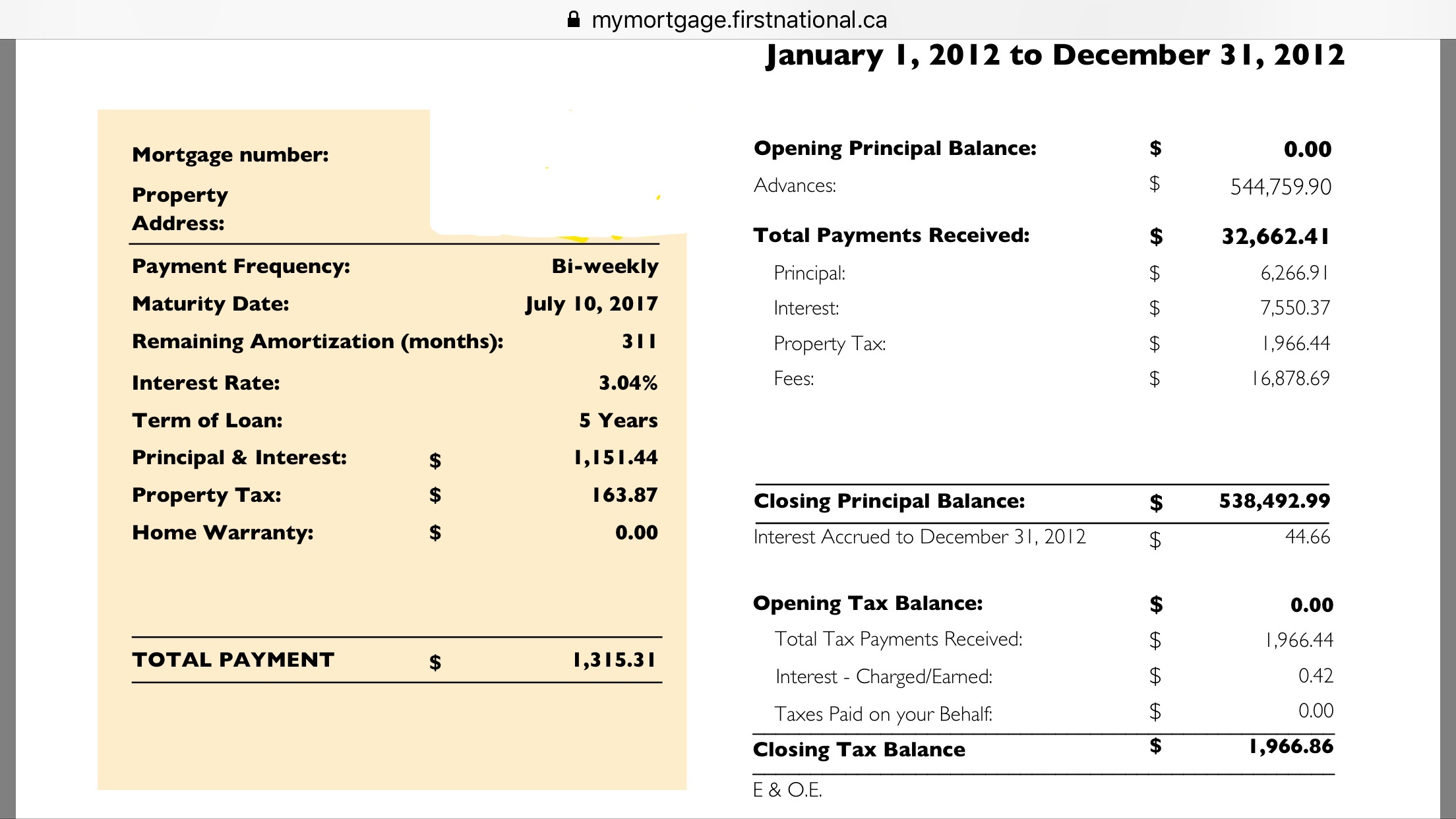

As you can see below, in 2012 we paid $32K, but only $6K went to principal!!

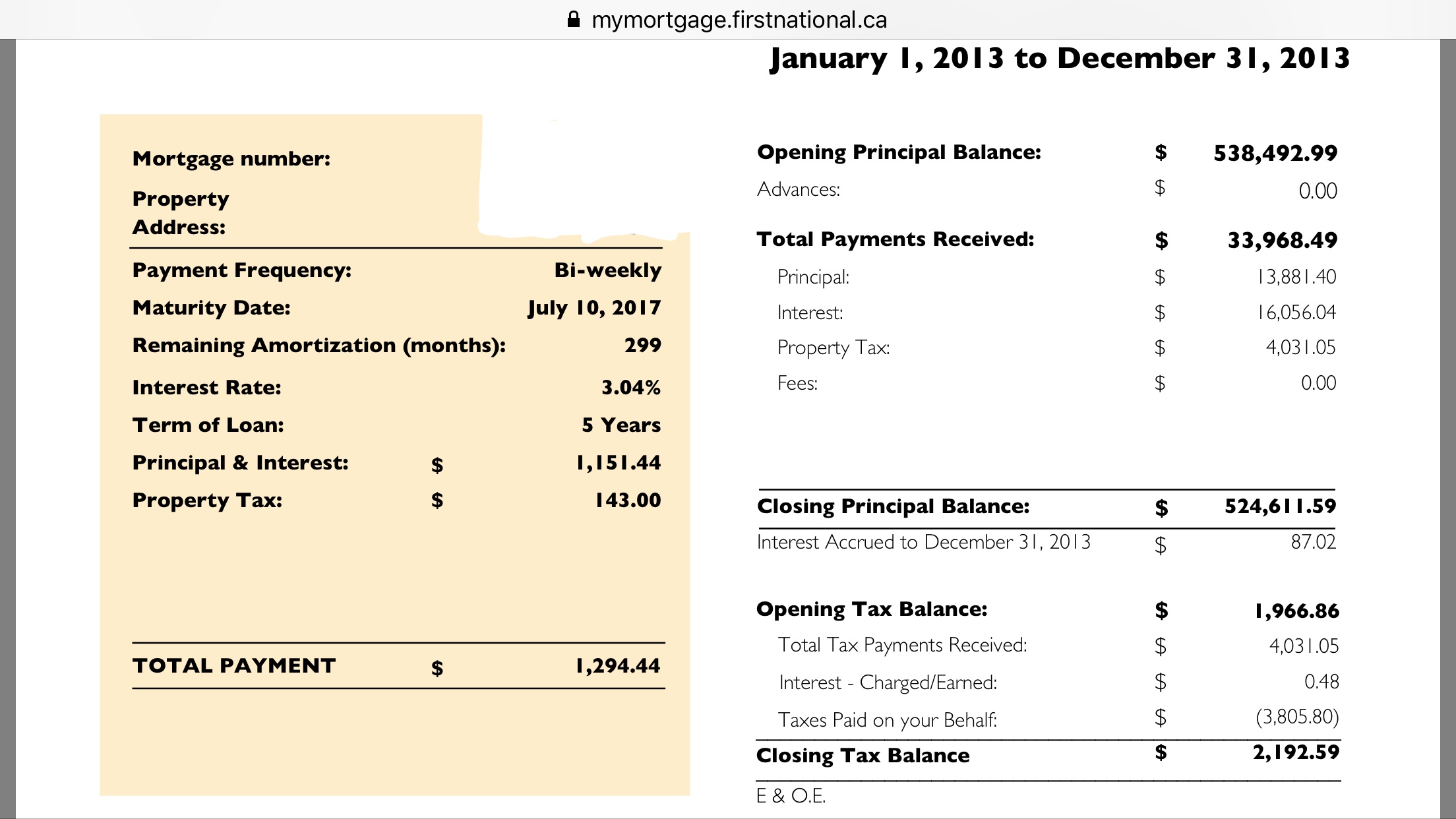

Below, you can see that in 2013, we paid $33K, but only $13K went to principal and the rest went to interests.

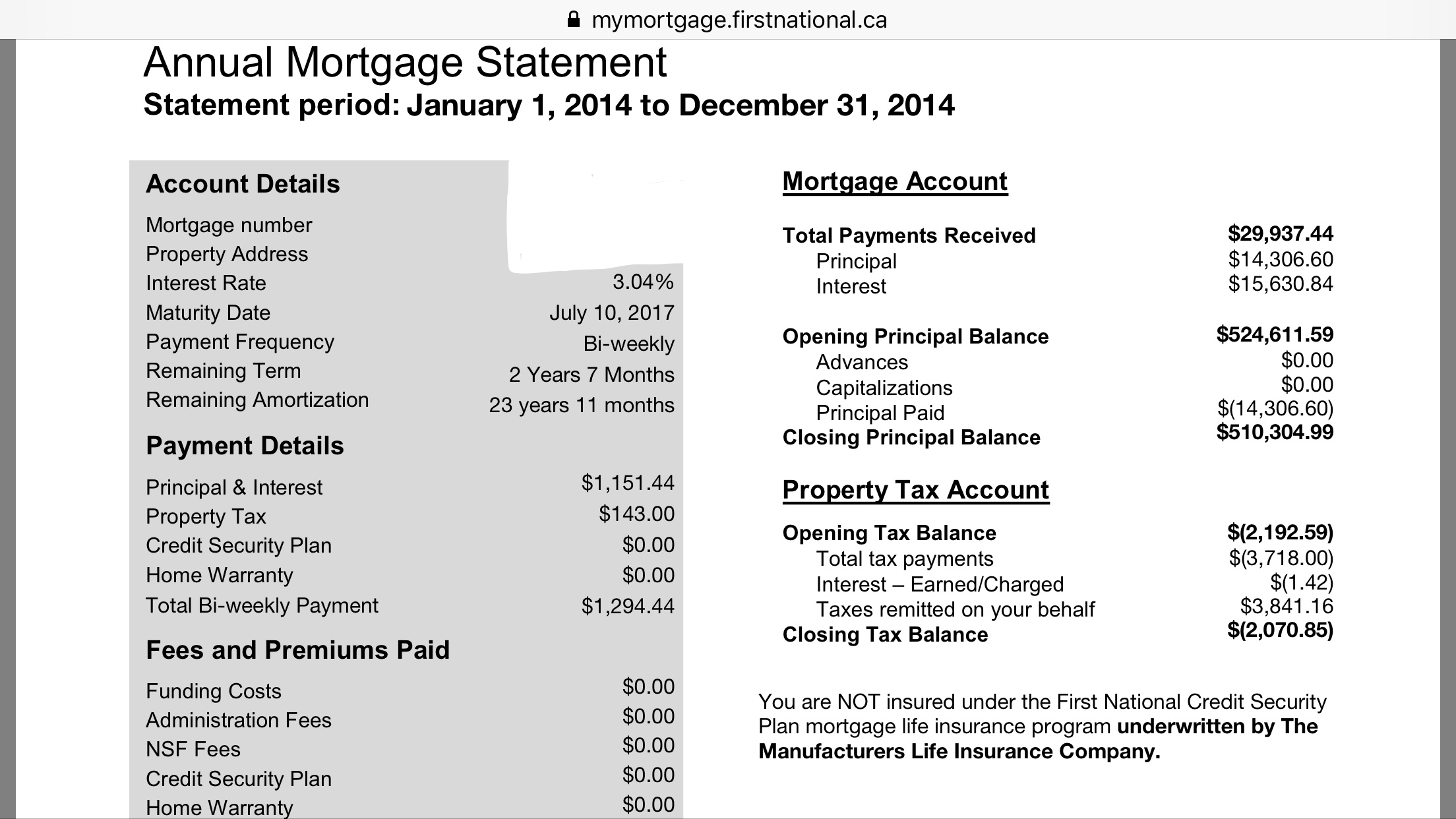

Same thing for 2014, we paid $29K, but only $14K went principal and the rest went to interest.

How your house actually costs you double the price

Using this RBC Canadian mortgage paydown calculator, I did some calculations to see how much we would pay in interests if we did not make any extra payments over 30 years at an average of 6% (unlike in US, In Canada, most mortgages are renewable every 5 years, therefore the interest rate is only guaranteed for the 5 years.

Thus, even though we did have a somehow low interest of 3.04%, we did not know what kind interest rate we would be able to get at 5, 10, 15, 20, and 25 years).

The screen below shows how much we would pay in interests if we did not make any extra payments over 30 years at an average of 6%. We would end up paying $621K in interest, more than the costs of our house of $557K for a whopping $1.18 MILLION!!!!

How we are saving $500,000 in mortgage interest

With our new plan, instead of paying $621K in interest, we will end up paying a little over $100K, which means the new plan save us at least $500K in interest. How awesome is that???!!!! And that’s interest we could not even deduct since in Canada, mortgage interest is not tax deductible unlike in the US.

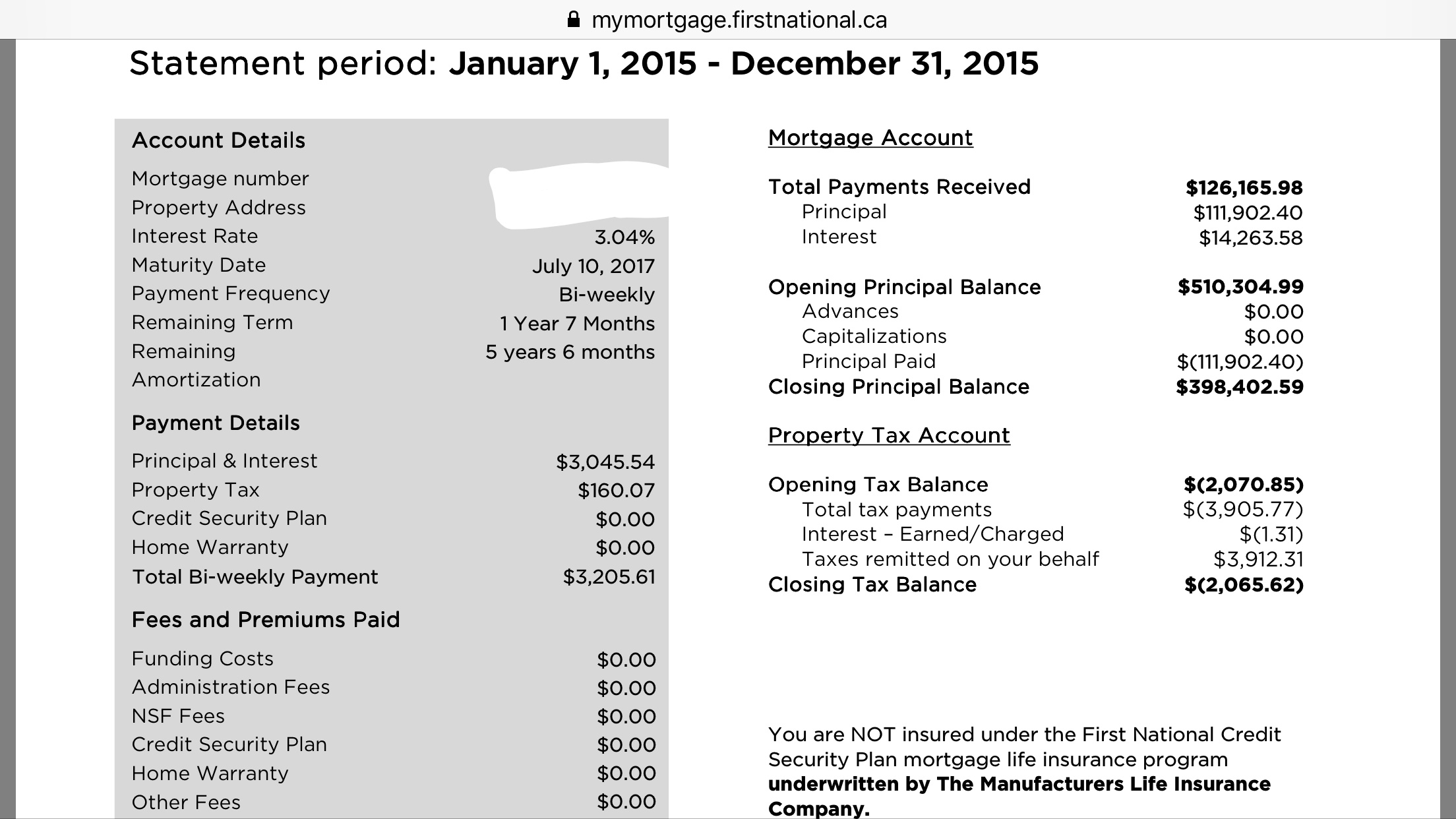

After I showed hubby all the above, he finally agreed with me that we should sacrifice some of the luxuries and try to pay off our mortgage within the next 5 years no later than 2020. Thus, in 2015, we made a huge effort and paid $126K and the majority ($111K), went to principal. Finally!!!

And as you can see our mortgage moved from the 500’s to the 398K.

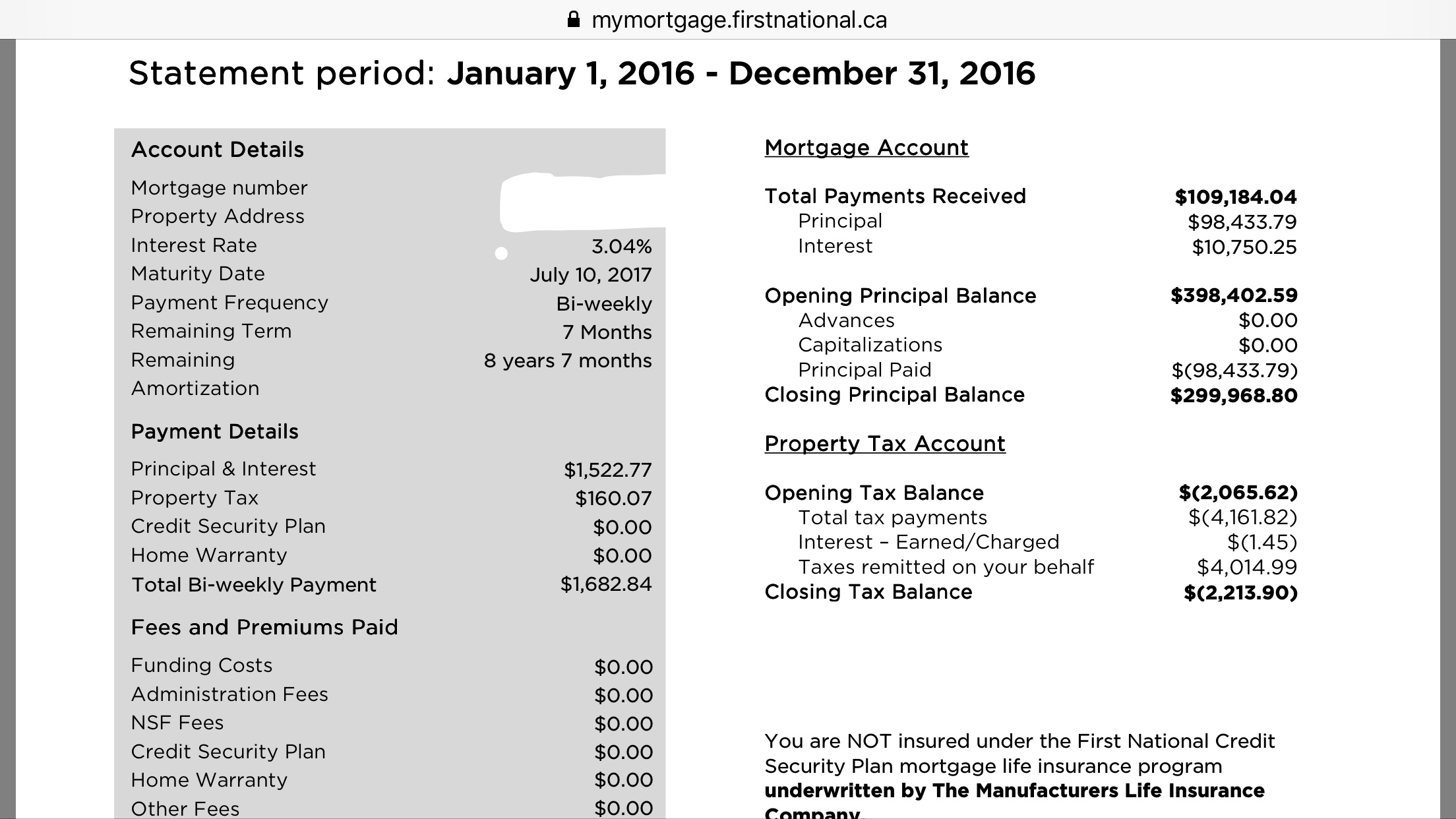

We continued the momentum in 2016, and our goal was to move the outstanding mortgage from the 300’s to the 200’s. And we did it! We decreased the mortgage from $398K to $299K.

Now, can we pay off another $100K in 2017? We are not too sure. With a newborn, our expenses have been higher than before and about to get even higher since she just started daycare in a couple of weeks. However, we have a plan B.

How to pay off your mortgage fast

Here are the 5 ways we have used (that you can also use) to pay down the mortgage faster:

- Read the Dave Ramsey book: Total Money Makeover . One of the things that really helped us was reading Dave Ramsey book: Total Money Makeover We are looking forward to reaching BabyStep7: Build Wealthy and Give.

Dave likes to say “Live like no one else so later you can live and give like no one else”. You may not agree with everything the talks about but you will agree with at 70% of it and you will learn a lot from him.

- Cut unnecessary expenses and spend mindfully. See How we live on 15% of our income.

- Find ways to increase your income. In the past 5 years, we have more than doubled our income. We wrote about it here How We Increased Our Annual Income From $0 to $160K to $400K+.

Make sure you also check out How To Negotiate Your Salary Like A Pro .

- Take advantage of your mortgage lender’s penalty-free, pre-payment options. For example, our lender allows us:

- Annual lump sum: Every year we can pay up to 15% (might be different depending on the mortgage lender) of our original mortgage balance. We do this usually every quarter or semi-annually. The payment applies directly to our principal.

- Annual payment increase: Once per year we can increase your payment amount by up to 15% (might be different depending on the mortgage lender). The payment applies directly to our principal.

- Double up: We can double up our payment of principal and interest on any regular payment date (might be different depending on the mortgage lender). The payment applies directly to our principal. We did this before we had the baby.

- We can change your payment frequency once every 12 months during the mortgage term (might be different depending on the mortgage lender). Our payments are bi-weekly which means an extra payment goes to the principle each year.

When shopping for a mortgage lender, make sure you know what kind of penalty-free, pre-payment options they offer.

5. Don’t stress yourself too much, have options. Sometimes life happens, and we need to readjust. For example, in our case, we are on Plan B and we also have plan C, and D already planned just in case:

- Plan A – Pay off our mortgage by Dec 2019.

- Plan B – With a newborn, our new plan is to pay it off in 2020 when I’m 39, and just before hubby turns 40.

- Plan C – Pay it off by 2021, just before I turn 40.

- Plan D – We just renewed the mortgage for another 5 years at 2.44%, and Plan D, would be to pay it off by end of the term in 2022, so we don’t have to renew again.

Benefits of paying off a mortgage early

Some of the benefits include:

- Decrease in amounts of interests you will pay overtime. As illustrated above, we will be saving $500K in interests

- Peace of mind. We were very stressed having that huge mortgage over our heads. And now, we are less stressed, and we can even live on one income if we wanted to; and we can survive the next inevitable recession. One of our biggest fears is being homeless. It probably comes from our poor beginnings when we weren’t sure whether we would be able to make rent the following month.

- A paid off house gets you closer to financial independence. In order to achieve financial independence, you would ideally have your mortgage already paid off, unless it’s a mortgage on a rental property that brings in enough rental revenue to cover the mortgage and other expenses.

- One of the unexpected benefit, is that since we made the decision to start paying off the mortgage, we have been very resourceful in terms of increasing income. We also started spending mindfully, and it has become second nature to us.

- Another unexpected benefit, is that since decreasing our mortgage to something we feel is more manageable, it has psychologically allowed us to start taking additional risks in order to increase our income. For example, since slashing our mortgage in half, we have come up with a few risky but potentially lucrative projects that we are working on, that otherwise we would not have started, if we still had that huge mortgage hanging over our heads.

Here are some of my fellow bloggers that have paid off their mortgages

- Million Dollar Journey paid off his mortgage at 31 years old!

- Ms Mazuma bought her last house in cash after loosing her houses during the last market crash

- Sean Cooper paid off his mortgage at 30 years old!

I always say that instead of giving the money to the bankers, give it to charity instead. We want to challenge our readers to find a way to pay off their mortgage within 15 years max, ideally 5-10 years. A paid off house, gets you closer to financial independence.

What are your plans with the mortgage? Do you also hate paying interest? How prepared are you for the next inevitable recession? Do you have a VISION2020? A goal you would like to achieve in 2020 finance or non-finance related?

Feel free to comment and share. Let us know about your dreams, goals and aspirations. We love ya and wanna get to know ya!

Do you want to learn more about us? If so, you can also read these posts:

- About us

- How We Increased Our Annual Income From $0 to $160K to $400K+

- How we live on 15% of our income

- Joining the Million Dollar Club/Challenge and So Can You

- How To Pay Off A Mortgage In 5 Years

- Our Biggest Money Fight and 9 Lessons Learned

- Our 6 Financial Mistakes and 15 Lessons Learned

- How I Paid Off My $40,000 Student Loans Before Graduating

- The resumes that bring in $400,000+/year (Samples Provided)

You may also like...

42 responses

-

[…] How To Pay Off A Mortgage In 5 Years […]

-

[…] How To Pay Off A Mortgage In 5 Years […]

-

[…] How To Pay Off A Mortgage In 5 Years […]

-

[…] we are trying to pay off our $500K+ mortgage within 5 years by 39 years. We are halfway through and on track. It’s very tough and challenging especially that we just had […]

-

[…] Avoid debt like the plague. We have paid off our student loans, our stupid car loan, and we are now trying to pay off the mortgage within 5 years by 39 years. See how are doing it here. […]

-

[…] How To Pay Off A Mortgage In 5 Years – 99to1percent – We understand that not everyone can pay off their mortgage in 5 years, however these tips are relevant whether you want to pay off your mortgage in 5, 8, 10, or 15 years. We want to challenge our readers to find a way to pay off their mortgage within 15 years max, ideally 5-10 years. […]

-

[…] How To Pay Off A Mortgage In 5 Years – 99to1percent – We understand that not everyone can pay off their mortgage in 5 years, however these tips are relevant whether you want to pay off your mortgage in 5, 8, 10, or 15 years. We want to challenge our readers to find a way to pay off their mortgage within 15 years max, ideally 5-10 years. […]

-

[…] How To Pay Off A Mortgage In 5 Years – 99to1percent – How to pay off your mortgage fast. We do this usually every quarter or semi-annually. The payment applies directly to our principal. Annual payment increase: Once per year we can increase your payment amount by up to 15% (might be different depending on the mortgage lender). The payment applies directly to our principal. […]

-

[…] How To Pay Off A Mortgage In 5 Years – 99to1percent – How to pay off your mortgage fast Here are the 5 ways we have used (that you can also use) to pay down the mortgage faster: read the dave ramsey book: total money makeover . […]

-

[…] How To Pay Off A Mortgage In 5 Years – 99to1percent – We understand that not everyone can pay off their mortgage in 5 years, however these tips are relevant whether you want to pay off your mortgage in 5, 8, 10, or 15 years. We want to challenge our readers to find a way to pay off their mortgage within 15 years max, ideally 5-10 years. […]

-

[…] How To Pay Off A Mortgage In 5 Years – 99to1percent – Hello readers, Today, we are going to talk about how to pay off a mortgage in 5 YEARS drawing on our own experience. As part of the plan to achieve financial independence, we have what we have dubbed Vision2020: To pay off our $550,000 mortgage in 5 years by 2020 at the age of 39 years old.. We understand that not everyone can pay off their mortgage in 5 years, however these tips are relevant. […]

-

[…] How To Pay Off A Mortgage In 5 Years – 99to1percent – Today, we are going to talk about how to pay off a mortgage in 5 YEARS drawing on our own experience. As part of the plan to achieve financial independence, […]

-

[…] How To Pay Off A Mortgage In 5 Years – 99to1percent – If you think, you won't be able to pay off your mortgage within 15 years, we should sacrifice some of the luxuries and try to pay off our mortgage a little bit faster. […]

-

[…] How To Pay Off A Mortgage In 5 Years – 99to1percent – As part of the plan to achieve financial independence, we have what we have dubbed Vision2020: To pay off our $550,000 mortgage in 5 years by 2020 at the age of 39 years old. We understand that not everyone can pay off their mortgage in 5 years, however these tips are relevant whether you want to pay off your mortgage in 5, 8, 10, or 15 years. […]

-

[…] How To Pay Off A Mortgage In 5 Years – 99to1percent – We understand that not everyone can pay off their mortgage in 5 years, however these tips are relevant whether you want to pay off your mortgage in 5, 8, 10, or 15 years. We want to challenge our readers to find a way to pay off their mortgage within 15 years max, ideally 5-10 years. […]

-

[…] How To Pay Off A Mortgage In 5 Years – 99to1percent – Today, we are going to talk about how to pay off a mortgage in 5 YEARS drawing on our own experience. As part of the plan to achieve financial independence, we have what we have dubbed Vision2020: To pay off our $550,000 mortgage in 5 years by 2020 at the age of 39 years old. […]

Hi there,I log on to your new stuff named “How To Pay Off A Mortgage In 5 Years – 99to1percent” on a regular basis.Your humoristic style is awesome, keep doing what you’re doing! And you can look our website about love spell.

Thanks, I’m glad you enjoyed the article.

Hey – thanks for the mention!! I am the poster girl for what not to do in real estate. 🙂 Of course, with that lesson I learned exactly what to do so it was totally worth it!!

Question – I don’t know how it works in Canada, but here in the states if your get your house reappraised and the value has gone up (as yours has) so your loan to value is over 80/20 then you can drop the mortgage insurance. Is that a thing there? That could save you a bunch in the long run. Either way, keep it up. You guys are kicking ass!!

Hi Miss Mazuma, we are not as lucky as you guys. In Canada, the insurance fee is a non-refundable, one time fee that’s “front-loaded” on the mortgage and added to the balance. The good news is it’s portable should someone change houses and they still don’t have 20% down payment. They wouldn’t need to pay the fee again. However the government might change the rules as they are introducing new rules/changes every few months trying to cool down the hot Canadian real estate market.

Hurrah for you! For others trying to pay off early here is a calculator which will tell you how much extra you need to pay each month to pay off on a particular date

https://www.yourmoneypage.com/home/mortgagepod.php

Thanks Mark, will make sure to check out the calculator.

Interesting and helpful. Thanks!

Glad you found them helpful. Thanks

Great post. Congrats on the plan. All of your choices (even D) are great ones. Just don’t let the new baby expenses throw you off track.

As a US resident I struggle with the arbitrage of mortgage balance vs. investment funds.

Tax deductibility, low interest rates, and good stock market returns have made my high mortgage balances the right call for the past several years.

Freedom from debt, guaranteed rate of return, and planning not having a house payment in retirement are the counter arguments to the above.

Everyone needs to make their own choice as to how to best reach the ultimate goal of financial independence.

Thanks for the great website and wonderful attitude!

I have the same internal struggle with my mortgage. I have no interest in paying it off early at this point in time because I am investing so much money in the markets and it’s such a low rate locked in for 30 years. If I wanted to quit working, I’d consider paying it off first or moving somewhere cheaper.

It’s nice to have options 😉

Hi Eric,

Thanks for stopping by and commenting. Yes, everyone has to make their own choice as long as it’s choice they can live with. There’s really no right or wrong answer.

Thanks for the mention Ms 99to1percent, and congratulations on your financial success!

Thanks for visiting. It’s an honor to have the legend here visiting!

That was a really helpful post. Thanks!

Thanks, glad you found it helpful!

One of my coworkers asked if she should pay off her mortgage. Her accountant said to keep it because of the tax deduction. My answer was to fire her accountant. This is one of the most common myths about money I hear. I said you want to give the bank 10k to avoid giving the government 3k. Instead, give your 401k and you get the same net result, except YOU are 10k richer. When we bought our first house, I had read a strategy to pay off your mortgage of in half by doubling the principle payment. I remember my brother, who I respect highly in these matters dismissed the idea and said that it would not work. We paid the extra principle every month and it was on track to payoff in 15 years. As our income went up we ramped up our payments and paid it off in 11 years. I highly recommend Dave Ramsey also. One point that he brings up about debt including mortgage is that it frees up you salary for wealth building. Once your house is paid off you can invest the previous payment. If Mr and MS99to1 invested what you are currently paying, you would have a million dollars in seven years.

Wow, congratulations on paying off your mortgage in 11 years! That’s so inspiring. Feel free to reach out through the contact form, should you want to guest post for us and let us know and our readers in detail how you were able to do it!

Nice article. I did this myself. I paid off $500k in less than 6 years and have had no personal debt since 2001. Wrote about it in my book The Doctors Guide to Eliminating Debt. I will vouch for debt free being a better life.

Dr. Cory S. Fawcett

Prescription for Financial Success

That means you have been debt free for 17 years! How cool!

I like all of your contingency plans. Nice to have options!

If you don’t mind sharing your living space, you could rent out a portion of the home which makes the mortgage interest tax deductible in Canada. That is a great option for some people and allows them to pay off the mortgage faster and claim the interest on taxes.

Yes, we could rent out our basement, but hubby does like his privacy 🙂 But we actually 1 room as an office, so we do get to deduct a portion of some of the expenses.

On the one hand I think 3% interest sounds amazing (ours is closer to 10%, and that’s a good rate in SA). On the other hand reading the rules around extra payments sounds like a drag. We can put cash into our homeloan whenever we want to, and take it out again, it’s totally liquid. The additional funds are counted against the principle. I guess each place has its advantages – although I’d still love a better rate!

Thanks for your post…. we have been just paying regular payments for so very long it is embarrassing. One day I decided to make it a game…. as I like fun alot. My mortgage company allows you to pay additional principle payments every day! Each am I schedule a new little payment. This is not something that I add on to the regular payment… it is an additional $10 or $20 dollars that I just schedule for deposit asap. This has taught me to get all touchy feelly with the actual mortage online payment info. I look at the principle each day go down. I watch with anticipation each month at the statement celebrating when I see how much the monthly interest goes down. I have even searched back 4 years to see how much in interest I was paying then…. and how much less I am paying now. Then I celebrate some more! Another fun way if you are an online seller like I am… say to yourself… the next item I sell I will deposit the funds into my mortgage payment… Everything should be fun! Kate

Hi There,

Really interesting article, we’re setting off on the same journey but here in the UK. Our mortgages are set up slightly different to those in the states, but the vast amount of interest paid over their lifetimes about the same if you don’t pay it off early 🙂

I can’t wait to see the back of it!